Front-line to the prep-line, Global Restaurant Point of Sale has you covered.

Global Restaurant Point of Sale is a suite of restaurant management software products built and managed in the cloud and accessed through a web browser or Apple iOS tablets.

Whether your establishment is counter service, table service, bar, or a mixture of all three, Global Restaurant Point of Sale can provide a cloud restaurant management solution.

Cloud Data Management

Cloud Data Management

Global Restaurant Point of Sale is managed entirely in the cloud and accessed in one single place. No more separate silos for your online ordering data, POS data, email engagement data, customer app data – everything is maintained and managed in Global Restaurant’s cloud database.

You can access your data from anywhere in the world from any device that can run a web browser. You can edit prices and add items to all your menus or run reports at any time from any place. It’s everywhere you need to be, whether that’s in the office, at home, or on vacation.

This capability is just built-in. No need to have extra licensing or on premises servers to maintain.

Reliable Apple Hardware

Apple devices are well known to be the most reliable devices available today and are enjoyed by consumer and business alike. They are solidly built, have great performance, and bridge the gap between quality and price reasonably well. In addition to their superior quality and performance for the price – nothing is more easy to understand and manage than an Apple device.

Data Redundancy

Data Redundancy

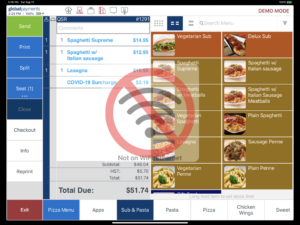

Although it is true that cloud technology is revolutionary in both management capability and deployment flexibility, any cloud enabled technology can be rendered useless when your internet service provider (ISP) is down.

That’s why the Global Restaurant Point of Sale app has been built with data redundancy built in. In the event that your internet connection becomes unreliable or disconnected, Global Restaurant Point of Sale will continue to operate and will use your Local Area Network (LAN) to continue to send prep tickets to your kitchen printers and or kitchen video system.

Staff can access guest checks from any POS station, can take and send orders to the kitchen, take cash payments, and print customer receipts. Once the internet is restored, all transactions are automatically updated to the cloud.

Time & Attendance

Time & Attendance

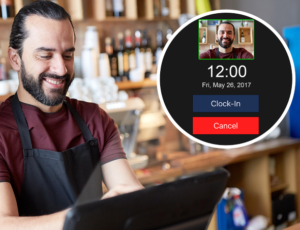

Improve labour management and eliminate “buddy-clocking” with Global Restaurant! We help restaurant owners with time keeping and employee management by providing time clock integration within the Global Restaurant Point of Sale system. Employees can clock in and out at each shift and Global Restaurant confirms identity by taking a photo. Managers can run employee labour reports and adjust shifts from the either the POS app or from the cloud.

If managers would like to communicate messages and reminders to staff coming on shift, one or multiple messages can be sent that will be read when they clock in and staff will be required to acknowledge those messages. Messages can be sent to all staff, a group of staff, staff with the same job, or an individual staff member.

Managers may also schedule staff in the POS to enforce employee schedules and prevent employees from clocking in before their scheduled shift.

Customer Display

Customer Display

The customer display comes built into the Global Restaurant Point of Sale system, providing guests an easy to read and accurate account of what the cashier is ringing in. As menu items are rung in, the customer display shows each item ordered, the quantity, and with any modifications requested. The customer display also has a summary that shows a running subtotal of the meal’s cost and the amount of sales taxes due on the order.

Customer displays improve order accuracy and order transparency. Customers can see their order as it is added into the system and can help the cashier make corrections as necessary before the order is sent to the kitchen, reducing errors before they happen, and saving the restaurant valuable time and money.

Once the order is paid, the guest may interact directly with the customer display to email, print or decline a transaction receipt.

Fast Order Entry

Fast Order Entry

Global Restaurant’s flexible interface supports any type of order entry method: fixed wireless or wired pos stations, as well as handheld wireless devices, for cashiers, table servers, and bartenders.

Restaurant’s that move at a fast pace with constant order entry will benefit enormously from the “Two-Tap-Ticket” functionality of Global Restaurant Point of Sale. Bar’s and Nightclubs will love the Fast Bar setup that Global Restaurant POS can provide.

Simply tap the item and the Fast Cash or Checkout button in two quick movements and your order is ready to be processed.

Host Waitlist Management

Host Waitlist Management

With Global Restaurant, third party guest list products and those dirty coaster pagers are a thing of the past! Host staff can manage guests arriving at the restaurant using the Wait-list built into the table management system in Global Restaurant Point of Sale.

Record party names as they arrive, make notes on preferences, requests, or special occasions, collect their cellular phone number, and save. Global Restaurant will track the guest’s time waited and when their table is ready, the host may “drag and drop” them from the waiting list directly to the table! As soon as the table is selected, Global Restaurant can automatically text the guest to let them know their table is ready!

Tableside Ordering or Line Busting

Tableside Ordering or Line Busting

Global Restaurant Point of Sale empowers service staff to send orders to the kitchen while on the move using a wireless iPad or iPad Mini either at the table or to help reduce lines. When used correctly, mobile order entry can enable service staff to increase sales, reduce order entry time, and turn tables faster.

For quick service operations, wireless handhelds can be used to pre-enter customer orders and move lines along faster while reducing prep times. Global Restaurant Point of Sale enables restaurant order taking whenever and wherever.

In either case, Global Restaurant Point of Sale provides service staff important product descriptions and information which can include ingredients, health attributes, and colour product photos that can be shown to guests. Global Restaurant’s upsell feature will remind servers to offer important add-ons and options that will enhance not only the guest experience, but the restaurant’s profits and the server’s tips!

Table Layouts

Table Layouts

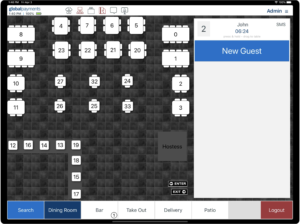

Whether you have a single room dining establishment, or a multi-room layout with a roof top patio and a party room, Global Restaurant Point of Sale makes it easy to track tables.

Restaurants can be organized into rooms using Global Restaurant’s easy-to-use graphical layout tool. Select from a variety of tables, objects, and backgrounds to give each room a unique feel and to best match the layout of your restaurant.

As table service status changes, so too do the colours, from open, served, or paid and completed, giving host and wait staff important visual cues about the current state of service.

Advanced Check Splitting

Advanced Check Splitting

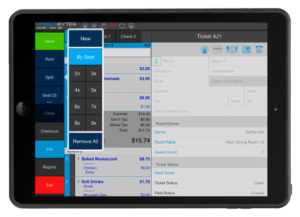

Servers can quickly split checks evenly or split by seats with a single touch. Checks can then be complete with any combination of cash, credit cards, and gift cards.

Adjustments and corrections can be completed just as effortlessly because Global Restaurant Point of Sale allows menu items to be moved between splits, and the split checks can easily be collapsed back into one single check with just a few taps to the screen.

Splitting items on Global Restaurant is just as simple, with servers able to split bottles of wine and appetizers between two or more guests at any time during the service. Make a mistake? Split items can be easily corrected without having to void and reorder the items. Now that’s easy!

Delivery Dispatch

Delivery Dispatch

Global Restaurant Point of Sale allows restaurateurs to easily manage delivery operations with the Delivery Dispatch system. Delivery Dispatch makes it easy to assign delivery orders to delivery drivers and provide them with turn-by-turn directions right from your POS terminal.

Caller ID for Takeout & Delivery

Caller ID for Takeout & Delivery

Improve efficiency and accuracy on busy nights by connecting your phone system to the Global Restaurant Point of Sale. When calls come in, restaurant staff can see who is calling, and the restaurant customer database is polled for information which is then automatically imported into the check when the order is taken. Servers save valuable time and improve accuracy by eliminating phone number entry, but they can also quickly see and reorder from a customer’s order history and use saved address information for deliveries.

3rd Party Delivery Service Integration

3rd Party Delivery Service Integration

Orders from online food-delivery platforms have gained quite a bit of attention from consumers recently, and restaurants have been scrambling to tap into the potential revenue streams from a myriad of delivery service providers.

As the number of delivery aggregators grows the challenge of accessing all of the different services requires an enormous amount of technology, procedures, and time to maintain, but refusing to work with a delivery service could inadvertently alienate loyal customers and potential profit.

Global Restaurant Point of Sale has an API that can integrate to almost every delivery service provider including: Door Dash, Skip The Dishes, Uber Eats, Ritual, and dozens of others.